2018 Tax Reform

Business Tax Reform - Why it matters:

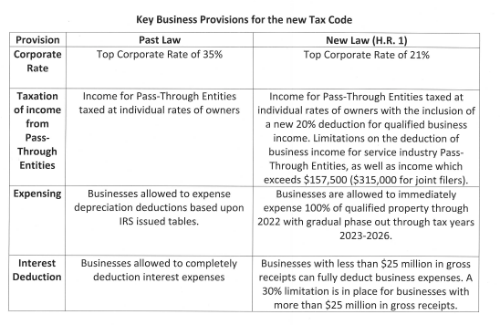

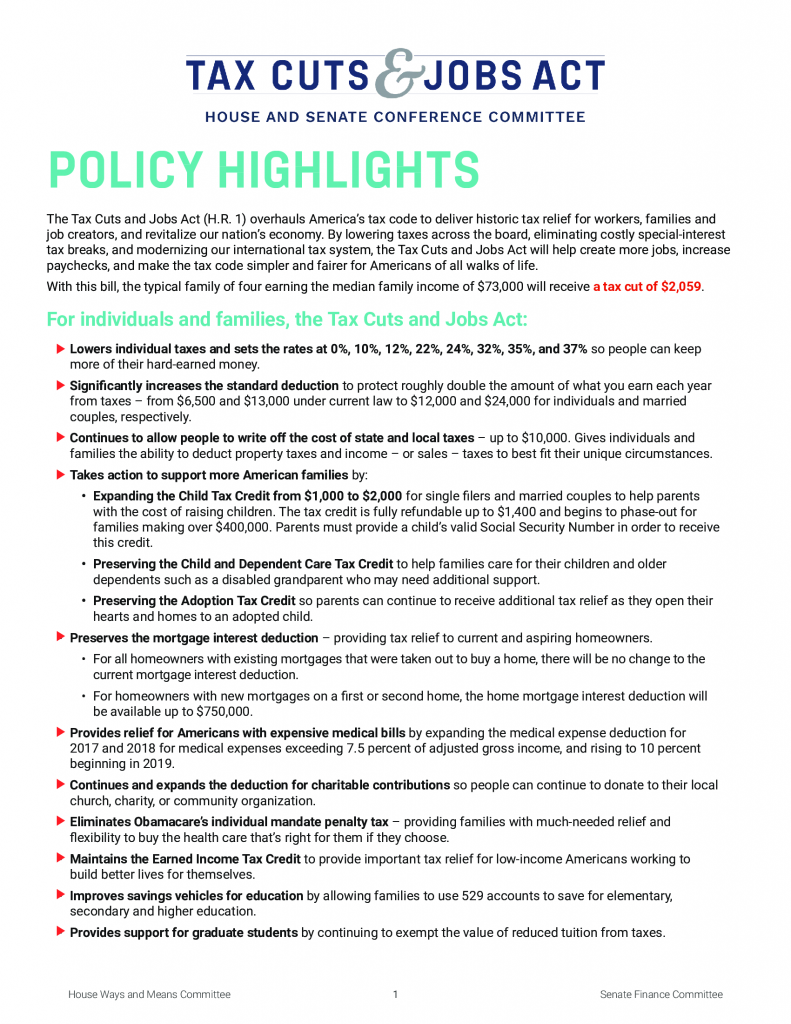

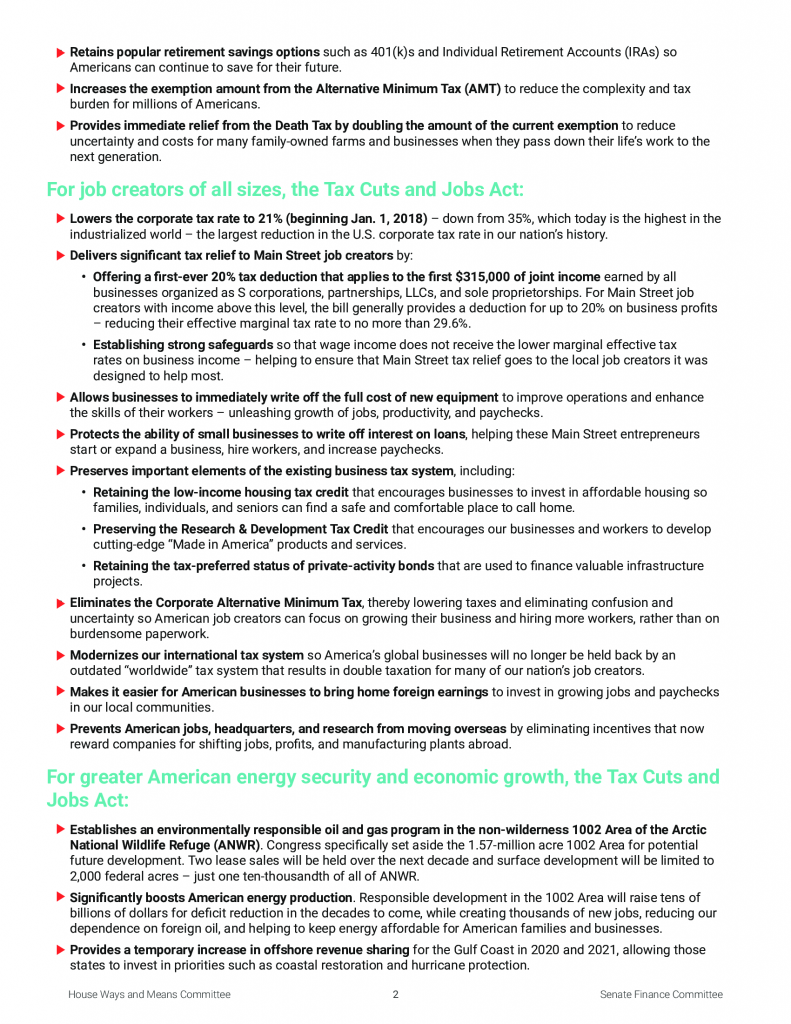

Objecting voices claim that the recently signed into law tax package benefits big businesses at the expense of working families. These same people forgot to mention that for years businesses and corporations, which hire working families, have been moving overseas to avoid our corporate tax rate. Our corporate rate was the highest in the industrial world, which cost us jobs and investment here in the U.S. For this reason, Congress slashed the corporate tax rate from 35% to 21% starting in tax year 2018.

But Congress didn’t just lower rates for the big corporations; it also slashed taxes for the small businesses taxed under the code’s passthrough system. Small businesses drive our economy and are located along main streets across the country. For years, local communities have seen their operating budgets drop because these shops close down, not to be re-opened. For this reason, Congress created a first ever 20% deduction for small business owners that applies to the first $315,000 of joint income. What this means is that many of our small business owners will see a reduction in their effective marginal tax rate to no more than 29.6%. Congress provided these cuts so that these businesses can be the economic anchors of their communities.

The changes don’t stop at just lowering rates for businesses though; Congress also retained the ability of small businesses to write off interest on loans, and also allowed businesses to immediately expense the cost of new capital equipment. On top of that, Congress created a new worldwide tax system which allows our domestic companies to be more competitive with foreign companies.

When combining all of these aspects, this means that businesses will have more money to compete, and to drive economic growth.